It can be difficult to save money these days, especially if you live on one income.

As a family of 3 (soon to be 4!) we’ve learned some strategies over the last few years that have helped us become debt-free and save thousands of dollars.

First, a bit about our situation..

Any time I read a blog post or article with advice, I like to understand a little more about the person giving said advice. So here’s a little info to help you understand me a bit more!

- My husband, son, dog, and I all live in a small house on my in-law’s property. By small, I mean 440 square feet! Because of our living situation, we do not own property or a mortgage. We rent from my in-laws!

- When we had our son almost two years ago, I left my [really good] job to become a stay-at-home mom. We felt convicted to not have our kids in daycare and knew that even though we’d be sacrificing lots more money, it was more important for me to stay home.

- We’re not considered low-income for our area, but are basically just above low-income.

Now let’s get into it

Okay so now that you have a bit more information about me, let’s get into the things we don’t buy as a family. Not spending money in these areas has allowed us to become debt-free and save thousands of dollars over the last few years.

#1. Food On the Go

When I worked in an office before having our son, it felt impossible not to eat out! Everyone was doing it all the time, whether it was getting lunch or even just a coffee. Since becoming a stay-at-home mom and transitioning to one income, we rarely eat out. It has saved us so much money, and now it feels like a really big deal when we do go out to eat. Recently, it was our wedding anniversary so we went out for dinner (truly, a rarity). We went to a simple chain restaurant and it was $87 after tax + tip. That’s almost our entire week’s worth of groceries right there.

Tips for not eating out:

- Make extra food at dinner so the working spouse can take leftovers for lunch

- Make coffee at home

- Keep snacks on hand in the car like granola bars and nuts; sometimes we tend to eat out just because we don’t want to wait until we get home!

- Try to experiment more with recipes, so that eating at home feels more exciting – use Pinterest as a resource

#2. Brand New… Anything!

I’ll be the first to admit that I love shopping. I’m into fashion and building a wardrobe I feel great in, and I get a lot of joy from home decor! Fashion and home decor are areas that change as the seasons in our lives do, so I feel like I’m always “seeking” to find new things home + clothing. On top of that, having a growing toddler and baby-on-the-way mean that we are currently cycling through lots of things very quickly (toys, books, clothing).

My biggest recommendation to you if you’re looking to save money but still need stuff, is to always thrift first. Almost my whole wardrobe is secondhand clothing and I’ve found so many gems at local thrift shops and even Facebook Marketplace.

Try to make it a point of looking at thrift stores and Marketplace first. Then if you really can’t find the item you’re looking for, then consider buying it brand new.

#3. Streaming Services, Subscriptions & Expensive Phone Plans

Have you recently looked at automatic subscriptions you’re paying for? Sometimes this can be a huge hidden cost for people, especially if you signed up for subscriptions and forgot about them. Automatic withdrawals are so easy to miss! I’ve personally signed up for free trials and forgotten to cancel on time, then realized months down the road that I was still getting charged. We currently don’t pay for any monthly subscriptions (bye bye Amazon Prime).

We also don’t pay for any streaming services! In our current stage in life, we don’t watch much TV honestly. However my husband and I do love watching a show or movie over the weekend! Even though we don’t pay for streaming services, we thankfully benefit from Netflix and Disney+ since my mother-in-law has an extra account on Netflix and my sister-in-law has one on Disney+. Do you know of anyone in your life that you could piggyback off of for streaming services? If not, check out free streaming websites or sign up for free trials of streaming services – just don’t forget to cancel on time! 🙂

Lastly, let’s talk phone plans. Do you need all that data you’re paying for? Can you minimize your phone plan costs and use wifi when possible? I used to pay $60+tax per month for something like 8 gigs of data. Somehow I would still go over the data limit and sometimes end up paying over $100 per month on my phone plan. Yikes. A few years ago my husband and I switched to a very cheap phone plan that just gives us the basics. It comes with 250 megabytes of data per month, which is helpful if I need to Google Maps a location or check something quickly online. We each pay $28 per month and I’ve never gone over my data. This change alone has saved us hundreds of dollars per year and I’d highly recommend looking into cheaper (maybe lesser known) cell phone plans.

#4. High Rent/Mortgage

I mentioned at the beginning of this post that we’re fortunate enough to have a small home/apartment on my in-laws property. I understand not everyone has that luxury but we have definitely made sacrifices in this area to save money over the years. When we were focusing on paying off debts, we moved in with my husband’s parents for a year so that we could have free living accommodations and tackle debt. We have also resolved to living in our (lovely) 440-square foot, 1-bedroom spot even as we raise children, in order to save up for a home.

If you’re paying premium every single month for an apartment that has amenities you could live without, consider moving + renting elsewhere.

If your mortgage payments are so high that you’re barely getting by and have no way to save money, would you consider selling your home and buying something cheaper?

I think we sometimes think we need tons of living space or we just want to feel like we’re living somewhere we’re proud of. What I’ve realized over the years is that you can make any house a home, and it feels really good to live below your means so that you’re not financially stressed every month. Sometimes temporarily living in an undesirable location can pay off – literally!

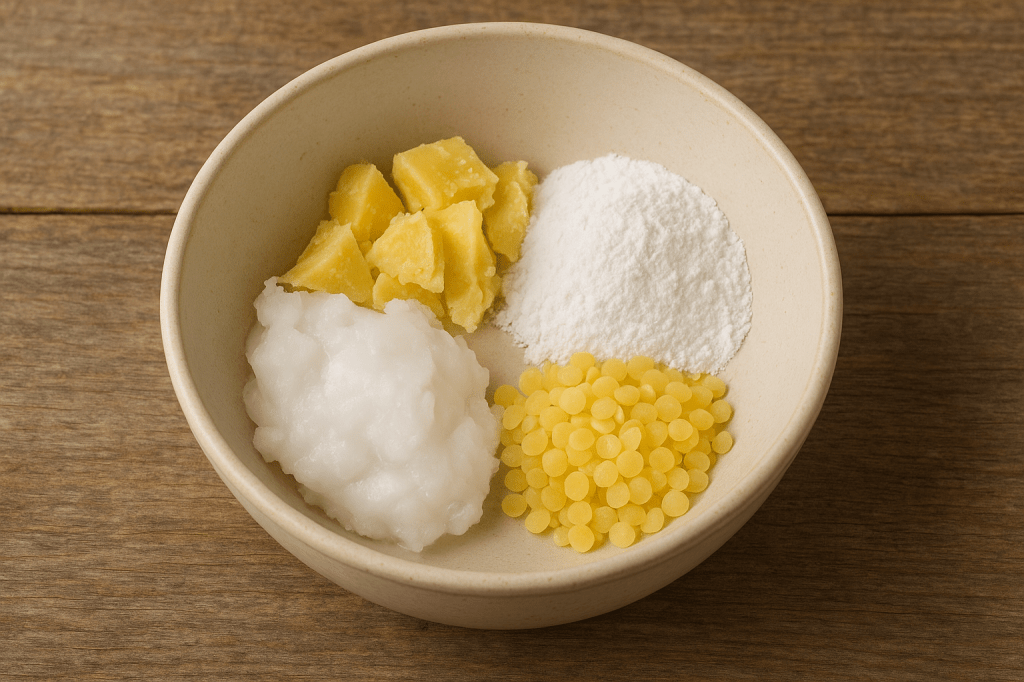

#5. Prepackaged Convenience Foods

I used to think that cooking from scratch was more expensive than buying prepackaged foods at the grocery store. While I’m sure that can be the case, I’ve definitely learned to be way more frugal with our grocery budget over the years.

By cooking mostly from scratch and paying close attention to the ingredient labels on foods, we’ve simplified our diets and meals significantly. Not only do we feel physically better from cutting out a lot of crap from the store, but we’ve saved so much money from making things ourselves!!

Things I make from scratch now that save us money

- Granola (check out my recipe here)

- Sourdough bread: I buy an 11 kg bag of flour every few months for around $20. We eat bread daily! A loaf of bread at the grocery store is easily $6 and would last a week or less for us.

- Pizza dough: I’m a big fan of Friday night pizza! We love making it at home and used to buy pizza dough for $5. Now I make it at home and it might cost $1?

- Desserts: Once you start making homemade desserts, nothing from the grocery store tastes quite the same. We always have pantry staples on hand so I can whip up something yummy that hits the spot for pennies. These cookies have been really popular.

- Iced coffee: Instead of paying for prepackaged cold brew or iced coffee, or even expensive creamers, I love making decadent iced coffees at home. My recipe?

- 1-2 tsp Instant Coffee

- 1 tsp Cocoa

- 1/2 tsp Vanilla Extract

- 1-2 tbsp Maple Syrup

- Add the first 4 ingredient to your cup with just enough hot water to mix up the coffee and cocoa so it’s not clumpy. Then add:

- Milk

- Ice

Conclusion

It’s difficult in this day and age to live on one income but trust me: it’s not impossible. If you’re willing to sacrifice some of the common luxuries in life, you can live more freely and experience a bit more financial freedom.

I wanted to honestly share with you what has worked for us. Maybe not all of these tips will suit your own life or situation, but I hope some of it can be applied to you.

Please leave a comment with any takeaways you have, or personal anecdotes from your own experience on living on one income.

Thanks for reading!

Leave a comment